-

Asia's leading independent regional equity house, providing investment services to institutional and private clients globally for over 100 years.

An Approved Financial Adviser (FA) & Islamic

Financial Adviser (IFA) of Bank Negara Malaysia -

Headquartered in Singapore and strategically positioned in 7 key Asian markets, UOBKH is listed on the Singapore Exchange (Ticker: UOBK).

A Capital Market Service (CMS) Licensed Entity of

Securities Commission Malaysia (SC) -

Strong global sales and distribution teams in 10 markets in Asia, the UK and North America with 1,600 professionals.

A registered Corporate Unit Trust Advisor (CUTA)

and Corporate Private Retirement Scheme Advisor

(CPRA) of Federation of Investment Managers

Malaysia (FIMM) -

-

Exchange participant in 7 regional markets: Singapore, Hong Kong, China (Shanghai B shares and Shenzhen B shares), Thailand, Malaysia, Indonesia, and the Philippines.

Head Quarter in Petaling Jaya & 4 Branches

(Penang, Ipoh, Melaka, Johor Bahru) and

13 Practice Offices across Malaysia. -

Independently managed and about 40%-owned by the United Overseas Bank Group (UOB) (Rated by Moody's Aa1 / S&P AA-).

UOB is one of the leading financial institutions in Asia and is listed on the Singapore Exchange (Ticker: UOB), with a market cap of around S$47 billion as of 28 Feb 2018.A wholly owned subsidiary of UOB Kay Hian Malaysia.

Our Value Proposition and Commitment

- Creditability

-

- A 100%-owned subsidiary of UOB Kay Hian

Sdn. Bhd.- A member of the SGX-listed UOB Kay Hian

Holding Limited Group - A 100%-owned subsidiary of UOB Kay Hian

- Asia-Centric

-

- Excellent local knowledge

- Extensive global connectivity

- Independent

-

- We act as a pure distributor

- We do not bind your portfolio to a specific product / product provider to avoid conflict of interest

- Open Architecture

-

- We work closely with various best-in-class product providers

- We source for and offer you the best-in-class solutions with competitive pricing and operational efficiency

Our Competitive Advantages

-

Full Spectrum of Wealth

Management Solutions -

- Unit Trust, Private Retirement Scheme (PRS), Fixed Income, Bonds, Structured Products

- Exchanged Traded Product (ETF), Equities, Futures & Options

- Life & General Insurance, Corporate & Employee Benefits, Legacy Planning

- Structured Financing

-

- Lend against marketable equities, fixed income instruments, mutual funds and structured products

- Provide competitive margin ratios with adequate risk control

-

Settlement

and Custodian -

- Settle and clear transactions in global markets

- Provide safekeeping services in global financial markets with timely entitlement

-

Flexible Order

Execution -

- We work closely with various best-in-class product providers

- We source for and offer you the best-in-class solutions with competitive pricing and operational efficiency

We Use a 4-step Portfolio Advisory Approach

to Invest Your Wealth with Care and Expertise

- Understanding

- Reviewing your current portfolio and understanding your: return requirements, risk tolerance, tax and regulation issues & personal restrictions

- Planning

- Based on your needs, we optimise risk / return, maximise return through leveraging & diversify risk through strategic asset allocation

- Implementing

- Sourcing the best prices from product providers, and executing your trade with cost-effectiveness & efficiency

- Managing

- Tracking & revaluating your portfolio with our consolidated statement, and adjusting based on your needs and market situation

With Our Open Architecture Platform,

We Offer a Full Spectrum of Wealth Management Solutions

- Unit Trust/Funds

-

- Connections with over 50 local and global fund houses with more than 3000 funds.

- Over 800 theme funds to access all investment opportunities, covering traditional unit trust, AI and shariah compliance.

- Take advantage of our portfolio planner for screening tools and search for Morningstar four- and five-star rated funds, socially responsible funds by fund family and more. Or choose your own search criteria for mutual funds.

- Set up customizable alerts based on price, volume, ratings, news and more. And uncover hidden concentrations in your portfolio with Portfolio X-Ray®, provided by Morningstar.

- Private Retirement Scheme (PRS)

-

- A voluntary long-term savings and investment scheme designed to help you save more for your retirement.

- Over 50 PRS funds from 7 PRS providers available for all Malaysians to supplement their retirement

savings other than EPF.- Corporate PRS Advisory, provide HR advise for staff retention and benefits.

- Fixed Income *

-

- Investment grade and high yield bonds across various issuers from different geographic areas and industries.

- All types available, whether simple as bullet bonds or complex as bonds with embedded derivatives.

- Find out more at UTRADE Bonds

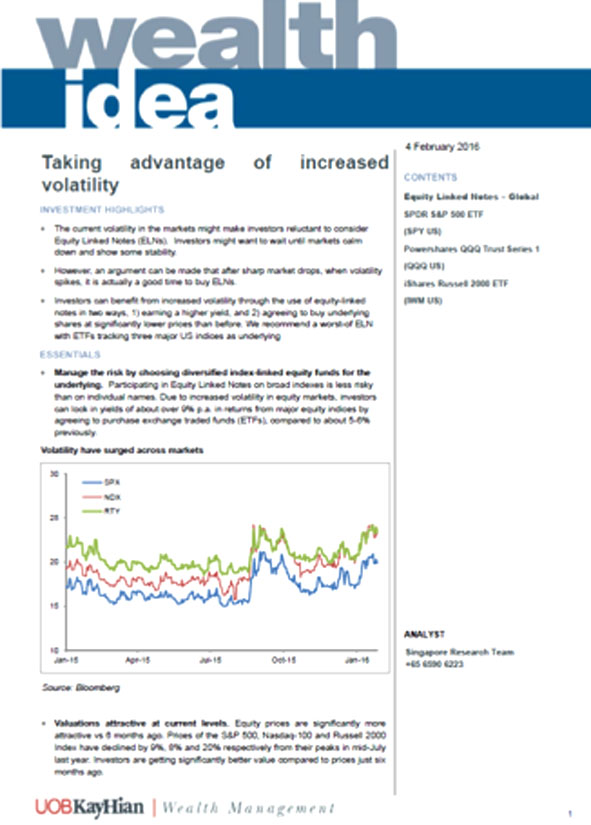

- Customised Structured Products *

-

-

- Partner with global best in class investment banks

- Product can be tailored to meet client needs, such as underlying instruments, tenor and payoff structure

- Available types: Equity linked note (ELN), Reverse equity linked note (RELN), Daily range accrual note, Fixed coupon note, Autocallable booster note

- Accrual Forward Contracts

-

- Buy (Accumulator) / Sell (Decumulator) specific equities / currencies at more favourable prices than market during a predefined period

- Leverage can be embedded in products

- OTC Options

-

- Available types: European / American type call / put, Covered call

-

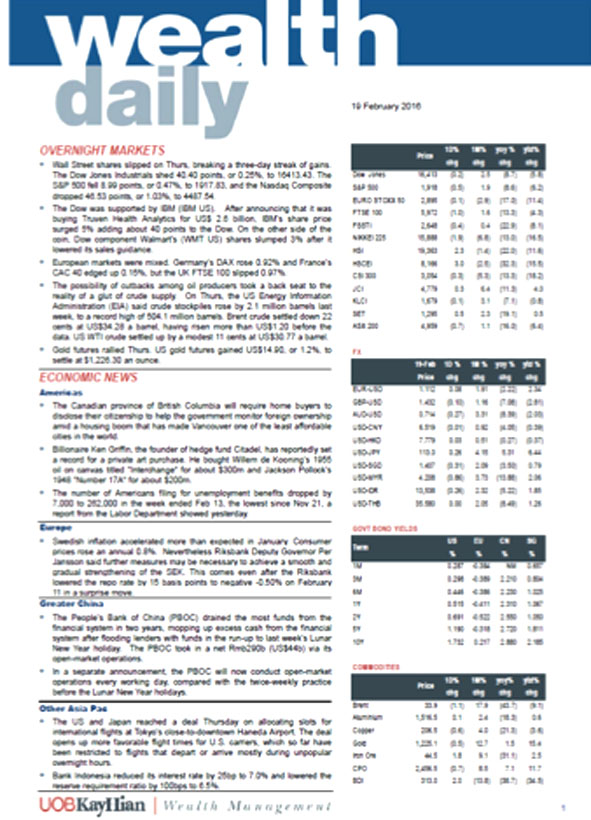

- Equities *

-

- Provide 24-hour online (UTRADE) / offline equity trading in Asian, European and North American markets.

- Options and Futures *

-

- Provide Hong Kong and US stock options trading.

- Provide index, forex, bullion, energy, commodity futures broking services

- CFDs *

-

- CFD 10 - Allows you to trade CFD Equities using leverage of up to 10X with interest-free financing

- CFD Equities - Go long or short with no hidden costs or spreads

- CFD Indices - Diversify your exposure over a basket of index component blue chips with up to 20X leverage

- Life & General Insurance

-

- Choice from:

- 11 Life Insurance Providers

- 11 General Insurance Providers

- 4 Takaful Providers- Protect yourself and your family against financial worries caused by ill health, pre-matured death, critical

illness, property damage, loss of business income and many more.- Connections with top rated onshore and offshore life & general insurance companies and family takafuls

offering you the most suitable solution. - Corporate & Employee Benefits

-

- Wide range of products offers protection to your business from building insurance, employee benefit to your valued staff and your business assets

- Legacy Planning

-

- Partner with best in class insurance companies / brokers in town.

- Help PWM clients with their wealth transfer and legacy planning needs.

- Provide premium financing to manage cash flow with more flexibility.

*These products & services are referred within UOB Kay Hian Group

**Equities, Options & Futures: Please refer to theList of Exchange Traded Products

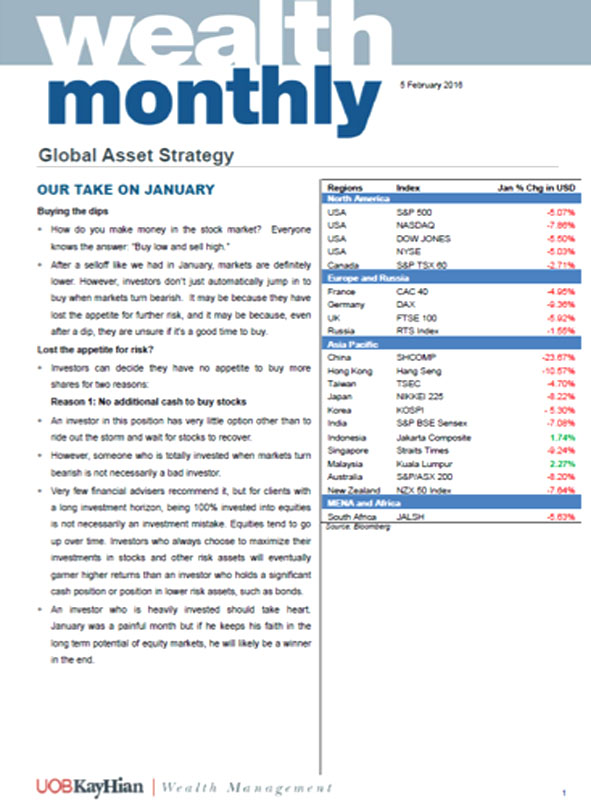

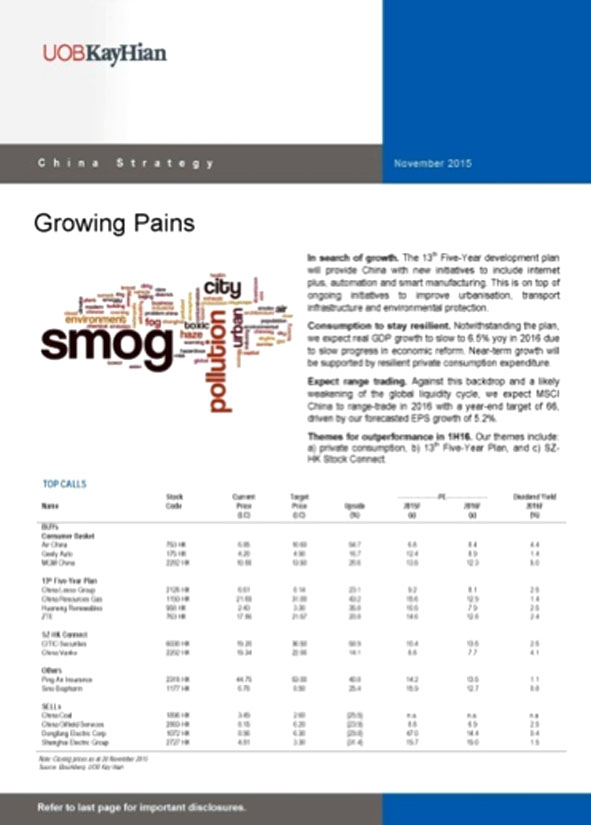

Our Research Series Provide Timely Analysis with Global Insights

-

- Asset class coverage includes: Equities, Fixed income, Commodities, Currencies

- Tactical product recommendations when special investment opportunities occur

- Equity Research

-

- Coverage of over 400 listed companies spanning various key sectors

- Award-winning analysts lauded by: Asiamoney , StarMine, South China Morning Post

Fulfilling Your Sophisticated Needs

with Our Credit Facilities

- Yield / Return Enhancement

- Amplify returns on investment through leverage

- Liquidity

- Enjoy full flexibility to draw down on standby funds for investment

- Monetisation

- Manage your cash flow without having to sell your assets

Effective and customised financing solutions to boost your

investment capacity and

manage your cash flow according to your needs and situation

* Service referred within UOB Kay Hian Group

Get in Touch

Let us contact you for all your enquiries, just drop us a message below.

Distribution Points

- UOBKHS

- UOBKHWA

- Central

- Southern

- Northern

- East Coast

- East MY

Central Region

- Sri Hartamas

- Kuala Lumpur

Sri Hartamas

N-1-3,Plaza Damas, 60 Jalan Sri Hartamas 1, Sri Hartamas, 50480 Kuala Lumpur

Tel: +603-6205 6000

UOBKHS: UOB Kay Hian Sdn. Bhd.

UOBKHWA: UOB Kay Hian Wealth Advisors Sdn Bhd

Complaint and Dispute Handling

For any complaint or discrepancies requiring resolution, you may direct your correspondence to the following email address: mycustomerservice@uobkayhian.com.

Your complaint and/or dispute will be acknowledged and investigated promptly, with an initial response provided within the next business day. A resolution shall be communicated to you not later than 14 business days from the email acknowledgement date.

In the event you are not satisfied with our final response to you, you may direct your complaint to FMOS (as below) within 6 months from the date of our final response letter; or after 60 days from the date your dispute was first acknowledge and there was no response from our end.

Financial Markets Ombudsman Service (FMOS) (200401025885):

FINANCIAL MARKETS OMBUDSMAN SERVICE (FMOS), is a merger between the Ombudsman for Financial Services (OFS) and the Securities Industry Dispute Resolution Center (SIDREC). For more information on FMOS, you can refer to the website at www.fmos.org.my

ADDRESS:

Level 25, Menara Takaful Malaysia,

No. 4, Jalan Sultan Sulaiman,

50000 Kuala Lumpur

PHONE:

+603-2272 2811 (9AM – 5PM Monday to Friday)